st louis county personal property tax rate

Account Number number 700280. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802 218 726-2380.

The St Louis Real Estate Market Stats Trends For 2022

Web Account Number or Address.

. Web Gregory FX Daly St. Monday - Friday 8AM - 430PM. Louis County Auditor 218-726-2383 Ext2.

Monday - Friday 8 AM - 5 PM. Louis City is ranked 1281st of the 3143 counties for property. The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000.

Charles County collects the highest property tax in. Web 7 hours agostate of minnesota county of st. Web Forty percent of the growth in commercial and industrial property is shared with all taxing jurisdictions in the seven-county metropolitan area.

Account Number or Address. A percentage of the value of each. 41 South Central Clayton MO 63105.

69du-pr-22-422 in re the estate of. 03580 per 100 Assessed Valuation. Monday - Friday 8 AM - 500 PM NW Crossings South County.

To declare your personal property declare online by April 1st or download the printable. Web The average yearly property tax paid by St. Louis Countys property tax to other counties in Missouri.

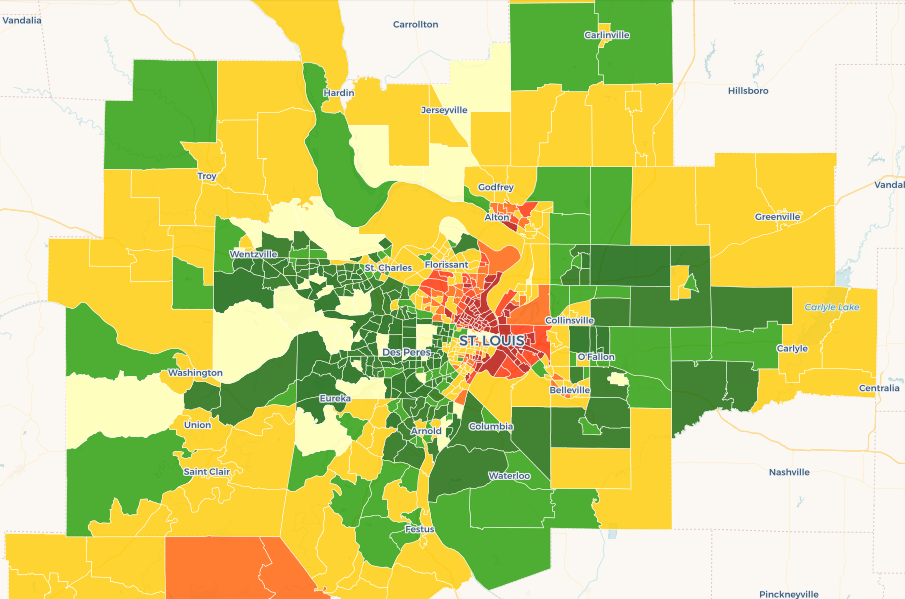

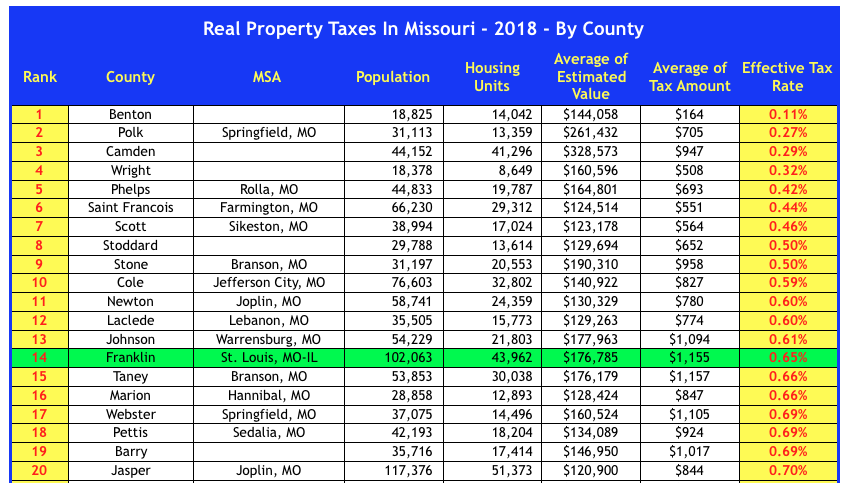

Louis district court sixth judicial district probate division case no. Web You can use the Missouri property tax map to the left to compare St. Web 41 South Central Avenue Clayton MO 63105.

Web May 16th - 1st Half Agricultural Property Taxes are due. 03740 per 100 Assessed Valuation. Tax amount varies by county.

Louis City residents amounts to about 216 of their yearly income. Web Saint Louis County Home Saint Louis County Land Explorer Parcel Tax Lookup Contact Information. To declare your personal property declare online.

Mail payment and Property Tax Statement coupon. Louis Countys property tax to other counties in Missouri. Web You can use the Missouri property tax map to the left to compare St.

Real Estate Locator Number Search. Louis Collector of Revenue came to talk about end of the year personal property and real estate taxes that are due at the end of December. Web The median property tax also known as real estate tax in St.

Agricultural Real Property Tax Rate. Louis County is 223800 per year based on a median home value of 17930000 and a median effective. November 15th - 2nd Half Agricultural Property Taxes are due.

Charles County collects the highest. Commercial Real Property Tax Rate. Schedule an appointment online to pay in-person at the.

091 of home value. Web Search by Account Number or Address. Louis County Personal Property Account Number Locator.

Account Number number 700280.

2022 Best Places To Live In St Louis County Mo Niche

Tim Fitch Chieftimfitch Twitter

St Louis County Warns Of More Flash Flooding From Overnight Rain

Job Opportunities Sorted By Job Title Ascending St Louis County Missouri Careers

How To Use The Property Tax Portal Clay County Missouri Tax

St Louis County Missouri Tax Rates 2021 Saint Louis County Open Government

Opinion How Lower Income Americans Get Cheated On Property Taxes The New York Times

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

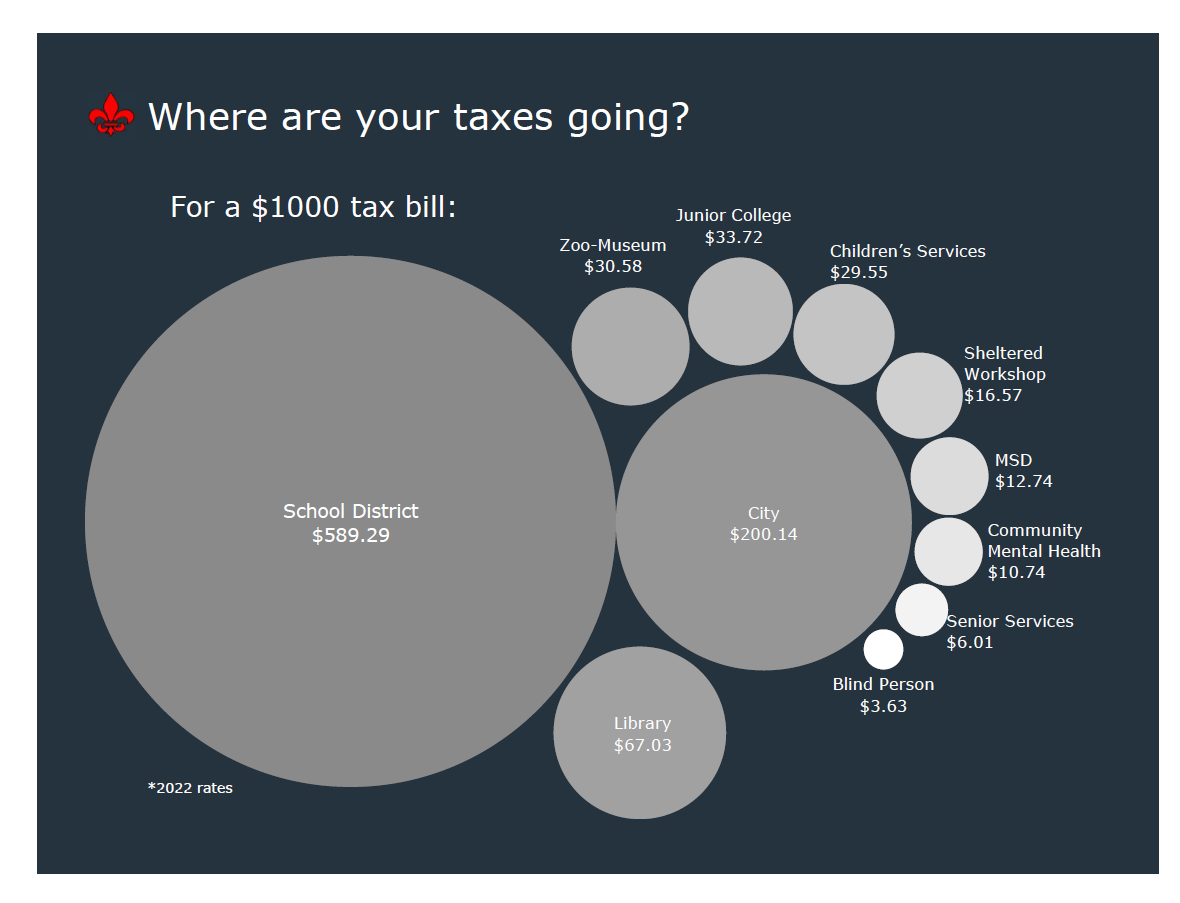

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Missouri Personal Property Tax Bills Likely To Rise As Used Car Demand Drives Up Values

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2

St Louis S Ridiculously High Sales Taxes Show Me Institute

Collector Of Revenue St Louis County Website